Home

BPI

Who is Benefit Professionals, Inc.?

Benefit Professionals, Inc. is one of the leading retirement plan Third-Party Administrators (TPA) in the Southeast with more than 30 years of experience in the industry. We oversee and coordinate all aspects of third-party administration, from annual compliance testing and governmental filings to plan document preparation, maintenance, and everything in between. We work alongside plan sponsors to help clarify clients' goals and objectives and provide customized benefit solutions with tailored services that best benefit our clients' goals. We provide work to our clients “signature-ready, distribution-ready” with a side of southern hospitality – it’s in our DNA.

What is a Third-Party Administrator (TPA)?

A Third-Party Administrator (TPA) is an outside party hired by the sponsor of a retirement plan to complete a portion or all compliance and reporting responsibilities of the plan. These duties include, but are not necessarily limited to, annual non-discrimination testing, preparing and filing the Form 5500 (tax return for the retirement plan), calculating employer contributions to the plan, processing distributions (including loans), monitoring timing of contribution deposits to the plan, preparing required annual reports, and preparing and maintaining the plan document.

SOLUTIONS FOR

FINANCIAL ADVISORS

Most advisors are not in the business of answering questions regarding day-to-day retirement plan administration, compliance, or plan design.

SOLUTIONS FOR

BUSINESSES

Business owners may provide a retirement benefit plan for their employees, but retirement planning is not their business. That is where Benefit Professionals, Inc. comes in.

SOLUTIONS FOR

NON-PROFITS &

GOVERNMENTAL ENTITIES

There are special tax-advantaged retirement plans specifically for government workers and certain other organizations and professionals.

January 2026

Time for Data Collection!

read more...

December 2025

Merry Christmas!

read more...

September 2025

Required Minimum Distributions

read more...

July 2025

BPI Mississippi Top Golf

read more...

September 2023

Roth Catch-Up Requirement

IRS Delays Roth Catch-Up Requirement read more...

September 2023

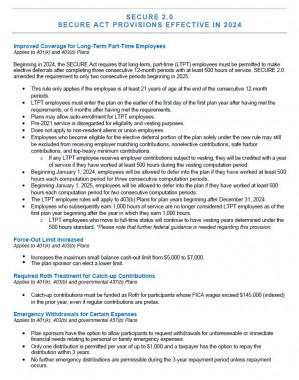

SECURE 2.0 Part 2 Effective in 2024

We recently sent an email regarding the SECURE 2.0 Act provisions that are effective for 2023. In this email we want to focus on the provisions that are effective for plan years beginning after December 31, 2023. Listed below are a few of the most impactful provisions... read more...

August 2023

Secure 2.0 Change (part 1)

The SECURE 2.0 Act of 2022 brings comprehensive changes to retirement plans and is the most extensive piece of retirement legislation since the ERISA Act of 1974. Read the full article to learn more about the provisions effective for 2023. read more...

September 2022

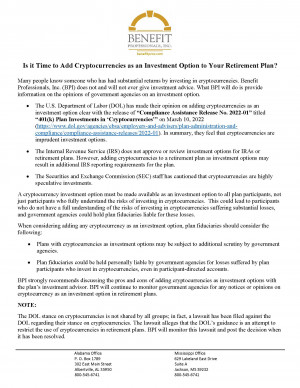

Is it Time to Add Cryptocurrencies as an Investment Option to Your Retirement Plan?

Many people know someone who has had substantial returns by investing in cryptocurrencies. Benefit Professionals, Inc. (BPI) does not and will not ever give investment advice. What BPI will do is provide information on the opinions of government agencies on an investment option. What does the Department of Labor (DOL), Internal Revenue Service (IRS), and Securities and Exchange Commission (SEC) say about cryptocurrencies in retirement plans? read more...

January 2022

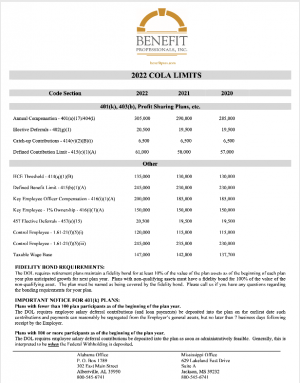

2022 COLA Limits

Benefit Professionals is here to help keep you up-to-date and aware of information within our industry. We are providing here for you the COLA (cost of living adjustments) for 2022. Our reference document shows the maximum benefit and contribution limits for 2022. These new limits become effective January 1, 2022. Some changes include: The Defined Contribution Maximum increased from $58,000 to $61,000 Annual Compensation limit increased from $290,000 to $305,000 Take time to review our documentation and contact us with questions you may have. read more...

January 2022

IMPORTANT DATES RELATED TO RETIREMENT PLANS

Be aware of all the important dates associated with retirement plans for calendar year end plans. We are sharing a reference list that will be helpful for you as you move through the year. read more...